Get the free 101 form

Show details

Prescribed by State Board of Accounts MILEAGE CLAIM (Governmental Unit) General Form No. 101 (1955) TO DR. On Account of Appropriation No. for (Office, Board, Department or Institution) DATE 20 FROM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 101 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 101 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 101 form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 101 form online. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

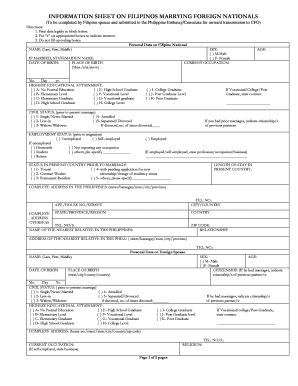

How to fill out 101 form

How to fill out form no 101?

01

Start by reading the instructions provided with the form. This will give you a clear understanding of what information needs to be provided and how to accurately fill out the form.

02

Begin by providing your personal details such as your full name, date of birth, address, and contact information. Make sure to double-check the accuracy of this information before proceeding.

03

Proceed to fill out the remaining sections of the form according to the instructions provided. This may include providing details about your employment, income, or any relevant documentation required.

04

If you come across any sections that you are unsure about or need further clarification, seek assistance from the appropriate authorities or consult the instruction manual for guidance.

05

Once you have completed filling out the form, review it thoroughly to ensure that all the information provided is accurate and complete. Make any necessary corrections if required.

06

Finally, sign and date the form where indicated. This will serve as your confirmation that the information provided is true and accurate to the best of your knowledge.

Who needs form no 101?

01

Individuals who are required to provide specific information about themselves or their circumstances may need to fill out form no 101. This could vary depending on the purpose of the form and the governing body or organization requesting the information.

02

Common examples of individuals who may need to fill out form no 101 include job applicants, individuals applying for licenses or permits, those seeking financial assistance, or individuals applying for certain benefits or services.

03

It is important to carefully read the instructions or consult the relevant authorities to determine if form no 101 is specifically required for your situation.

Fill form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form no 101?

Form no 101 does not have a universally standardized meaning or usage. The specific purpose or content of form no 101 would depend on the context or organization using it. It could be a form used for various purposes such as tax filing, registration, application, or documentation, but without additional information, it is not possible to determine its exact meaning.

Who is required to file form no 101?

Form 101 is not a specific form that is commonly associated with any particular requirement for filing. In order to provide a more accurate answer, please provide additional context or clarify the specific jurisdiction or context in which Form 101 may be relevant.

How to fill out form no 101?

To fill out form no 101, follow these steps:

1. Obtain a blank copy of form no 101. You can usually find this form on the official website of the organization or institution that requires it.

2. Read the instructions carefully. Each form may have specific instructions regarding how to fill it out correctly. Make sure you understand what information is being requested and in what format it should be provided.

3. Begin by providing your personal information in the designated fields. This typically includes your full name, date of birth, address, and contact details. Fill in each field accurately and legibly.

4. If the form requires you to provide information about your educational background, employment history, or any other specific details, make sure to do so in the applicable sections. Use additional sheets if necessary.

5. Complete any sections requesting specific documents or attachments. For example, you may need to attach copies of your identification documents, academic certificates, or other supporting materials. Make sure to include any required documents as indicated.

6. Double-check the form for completeness and accuracy. Ensure that all required fields are filled out and that all information provided is correct.

7. Sign and date the form in the appropriate section. If the form requires additional signatures, make sure to have them completed by the respective individuals as well.

8. Make a copy of the completed form for your records. This can be useful for future reference.

9. Submit the filled-out form as instructed. This may involve mailing it, submitting it online, or delivering it in person. Follow the provided instructions to ensure your form reaches the intended recipient.

Remember, the specific requirements and instructions for form no 101 may vary depending on the organization or institution, so it is important to carefully review the provided guidelines.

What is the purpose of form no 101?

Form No. 101 typically refers to a specific form used in various contexts, such as government filings or official documentation. Without more specific information, it is difficult to determine the exact purpose of Form No. 101, as it could vary depending on the organization or institution using it. It is best to refer to the specific organization or agency that issues the form to understand its purpose and requirements.

What information must be reported on form no 101?

Form No. 101 is typically used by businesses or individuals to report the details of income earned from salaries or wages. The specific information to be reported on Form No. 101 may vary depending on the country or tax jurisdiction. However, here are some common details that might be required:

1. Personal information: This includes the full name, address, contact details, and taxpayer identification number (such as social security number or national ID number) of the individual or business filing the form.

2. Employer details: The name, address, and taxpayer identification number of the employer from whom the income was earned.

3. Employment income: The total amount of income received from the employer throughout the year, including salaries, wages, bonuses, tips, commissions, and any other compensation.

4. Withheld taxes: The total amount of taxes withheld by the employer from the income, including federal, state, and local taxes, as well as contributions to social security, Medicare, or other mandatory deductions.

5. Deductions and exemptions: Any allowable deductions or exemptions that the individual is eligible for, which might reduce the taxable income.

6. Other income sources: If there are any additional sources of income outside the employment, such as rental income, capital gains, or self-employment income, these may need to be reported separately.

7. Credits and adjustments: Any tax credits or adjustments that may apply, such as education credits, child tax credits, or other deductions allowed by the tax laws.

It is important to note that the specific instructions and requirements for Form No. 101 may vary based on the tax laws and regulations of the specific country or jurisdiction. Therefore, it is advisable to refer to the official instructions provided by the relevant tax authority or consult a tax professional for accurate and up-to-date information.

When is the deadline to file form no 101 in 2023?

I apologize, but without specific context or jurisdiction, it is not possible for me to provide an accurate answer. Form numbers and their respective deadlines can vary based on the country or organization. Can you please provide more details or specify the applicable jurisdiction so that I can assist you better?

What is the penalty for the late filing of form no 101?

Form 101 is typically used to file an income tax return in certain jurisdictions, such as India. The penalty for the late filing of Form No. 101 can vary depending on the specific jurisdiction and its tax laws. In India, for example, if the income tax return is filed after the due date but on or before December 31 of the assessment year, a late filing fee of Rs. 5,000 may be applicable. If the return is filed after December 31, a late fee of Rs. 10,000 may be charged if the total income does not exceed Rs. 5 lakhs, and Rs. 1,000,000 if the total income exceeds Rs. 5 lakhs. Additionally, there may be additional interest charges for the delay in paying any income tax due. It is important to consult the relevant jurisdiction's tax laws or seek professional advice for accurate and up-to-date information on penalties for the late filing of Form No. 101.

Can I create an eSignature for the 101 form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 101 form online right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit 101form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing form no 101.

How do I fill out the 101 form form on my smartphone?

Use the pdfFiller mobile app to complete and sign 101 form online on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your 101 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

101form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.